This guide will walk you through the home insurance process, explaining everything you need to report an insurance claim, what you can expect from the process and how long you will have to wait before it is paid to you. We will also tell you when to apply, how to prove your claim and what information the insurance company will find out. Finally, we cover the mistakes you avoid in the process and what to do with things like a broken roof that needs to be fixed immediately.

How Do I File a Homeowners Insurance Claim?

Calling your home insurance company may not be the first thing you think of doing after a fire, flood, theft or other unfortunate domestic event. But it is important to do this as soon as possible, for security reasons and to start the acquisition process. In this section, we'll walk you through the application process, which includes the following steps:

1. If a police report is required If it is a criminal offense, such as theft or vandalism, file a police report before making any further calls. Be sure to write down the names of all police employees you speak to or who will inspect your property.

2. Let your insurance company know that your other call must be in your insurance or your home insurance agent. Most homeowners' policies require the insurance company immediately informed after all damage, theft, as injuries probably in claim. Although you may not need to call as soon as you do, it can start a quick recovery process. Report requirements may vary by insurance and condition, but your policy and support documentation will tell you what to do. Some companies can make online claims.

3. Make all urgent repairs Then make all the necessary emergency repairs that are necessary to prevent further damage without endangering yourself. Most homeowners' insurance policies allow this and some require it. Make sure you keep copies of all payment receipts and photograph the damage before performing any work.

4. Document the claim Document all damages, stolen items and anything that may be the basis of the claim. Take more photos as a video with details of the damage, go to the bedroom if necessary. This is especially important when urgent repairs are needed to keep the structure safe and habitable. Make a list of damaged, stolen or damaged properties together with their estimated value. This can be even faster if you have previously made a detailed home inventory of your property. The insurance company will arrange a meeting with an appraiser who will interview you and assess the damage to determine how much you can expect. Be sure to accompany the appraiser during the inspection and point out any damage to the structure as a problem area.

Filing a Police Report

Not all homeowners' insurance claims need to be reported to the local authority. For example, leaking roofs or wind damage are often not a good reason to contact the police. However, if there is any crime, such as vandalism or burglary, or if there is a fire, you should call the authorities as soon as possible. This also applies if someone is injured on your property. Share all important details of the incident with the authorities and keep copies of their reports. You need those when you submit your claim.

You don't have to call 911 call 911, except that the house is on fire, you think it's a thief in your house, has a real need. Most police units prefer the necessary calls for their reserved emergency. Discover vandalism or stems after reality is considered an unusual nour.

Some communities allow and encourage citizens to announce criminal activities online and serve their own police. After you enter some information about yourself, your location and the incident, your case will be numbered and you can print a copy of the report. An officer will follow you as needed.

When a police officer comes to your house, provide as much detail as possible about the incident, including reporting any damage to your house and identifying damaged or lost property. Answer all the officer's questions and carefully inspect the area yourself to make sure you haven't missed anything.

Notifying Your Insurance Company

Most domestic working local insurance, which you need to inform your insurer directly into the storm, theft, damage or any incident that can be prepared for payment or not. Your policy will determine what is necessary and where to start.

In addition to notice their insurance or insurance agent, some insurance companies can contact you online or through the application. If you do not make a small entitlement, it can be best to talk directly to the agent or representative of the company.

Before calling, read your policy to get an idea of what is not covered, some exceptions and limitations you can forget. If it's time because you purchased a policy, it was a good time for refreshing. Create a list of questions as you can undergo policies.

If little injury and restoration is most likely worth less than you want to send. They prefer to pay the pocket and risk not risk rates. "If the loss is acceptable or even if it's almost, I'll think twice about the application," said Jay Feinman at the University of Rutgers. Unfortunately, without an expert estimate, it is not easy to find out how much the repair will cost. If so, it will probably be best to call your insurance company. Your agent can help you with the cost estimate as an insurance agent, or you can consult your local construction company. Be sure to report and submit your claim within the deadlines specified in your policy.

If you are willing to announce your policy insurer, get your copy of the policy and a list of available questions.

Describe damage and confirm if you are covered or not. Don't be ashamed of questions and try to get a clear picture of what is in front of us. Ask how long it takes to get the necessary paperwork, and if you can complete it. Determine whether an estimate must be to be used for sizes to include their claims and if and if insurance tends to control damages. The better you are now, the better off you will be later. Remember that you do not need full details of the loss or a detailed inventory for the first call, but timeliness is important. If you call due to something like a hurricane that is causing great damage in your area, you want to queue for premiums and fix it as soon as possible. Describe the damage as much as possible, ask if you are covered and what details are needed from you. Find out how long you have to apply and start preparations accordingly.

Documenting Your Homeowners Insurance Claim

Applying for home insurance can be time consuming and tedious and requires a lot of attention to detail. But the better you are, the faster you will achieve leveling.

Keep records of every phone call and conversation you have as you go through the process, starting with the event that claimed. This record should include the date of the interviews and the names of the people you are talking to, from police officers to insurance representatives to contractors who provide estimates.

Take photos or record the damage, including as much detail as possible, and go to the room as needed. Now it's time to make a home inventory, if you have one, with photos of things before damage along with their estimated value. Provide this information to your insurer along with photos or videos describing the damage to make it easier to find out what is missing. If you do not have a visual record before the incident, you want to create a record that shows the damage along with a list of damaged or stolen items.

If the claim is the result of burglary, vandalism or other criminal activity, be sure to enclose a copy of the police report with the names of the officers you spoke to. If someone is injured on your property, be prepared to provide details and reimbursement of medical expenses and other cash expenses. Make sure you provide details of each specific requirement of your insurance company and provide all required backup documentation as a required confirmation. The more details you provide, the better off you will be.

Lastly, if your home is damaged to the point where it is uninhabitable or dangerous, keep all bills for hotels, meals and related expenses so that they can be reimbursed. Most homeowners' insurance policies cover these costs to cover loss of use.

Making Urgent Repairs

Don't wait for an insured animal to make an emergency in your house in your house as a delay leads to further damage. Even if you don't have to try to fix your abilities or you can't risk damage to your body, do not hesitate to cover damaged sails to keep rain. Steps stopping that it will protect your house and make it home until professionals come, and these steps may require your insurance company. "Politics often requires policies repairs to prevent further damage," Freeman. "It's on your best interests and her."

Press the receptions for all the materials you purchased to make emergency repairs such as tare, wood and hardware. Include receipts in the documentation you sent to your insurance company when you applied for a refund. Before you begin repairs, take photos or video of the damage to see what the damaged areas looked like after the incident. You want to submit them with claims.

Keep in mind that not all accidents should be reported and you can increase your risk by involving an insurance company. This is especially true if the damage is small and you can repair it yourself or hire a contractor who is lower or closer to your own risk. Unfortunately, it is not always easy to make a decision without professional help. If so, consider obtaining an estimate from your local supplier or informing your insurance company or agent. The only way to find out when you get paid and how much is to look at your insurance company. Doing so may also show hidden damage. Something that now looks like minor damage can lead to bigger problems later, so it's important to note this. Your insurance company will provide you with claims to fill and return, as required by law. These forms must be completed immediately, but again, this is your best interest to do it so that the process keeps. Take time to fill it with accurate and complete, and don't be afraid to ask.

When Should I File a Homeowners Insurance Claim?

If you are filing an insurance claim for homeowners, you must file it as soon as possible. This is usually after the insurance liquidator has inspected the property and made a report if necessary, and you are ready to deal with the contractors and begin the repair or rebuilding. Most policies require claims to be submitted within one year of the incident, but regulations vary from state to state.

You must first know if you want to make a claim. If the shaving repair is shorter or close to your own expense, you can repair it yourself or pay for the supplier out of pocket. It can be true, even if the cost of healing is very small at reception.

The reason is that the report that the claim can result in a customary or can cancel your policy. In addition, the record that the record will follow, even if you move to the home insurance company. Insurance companies share a database of information on the preceding claims, including guardian names and addresses, and claimed value and the dollar amount paid. Called the expanded absence of the lower shift, as a contribution of key insurance, who often contribute to the database and use them to help them identify rates. CLUE will be aware of each claim. Simply calling the insurer and requesting an insured event may result in an update of your CLUE profile and the data may be stored for a maximum of seven years.

In general, a call to your insurer or even a large insured event may not lead to an increase in the rate. There are many other factors involved in setting or raising rates, from your credit status, when you stay with the same insurance company, to the number of claims in your area. But if you have recurring claims in the past, you may want to consider adding to the minor damage list twice.

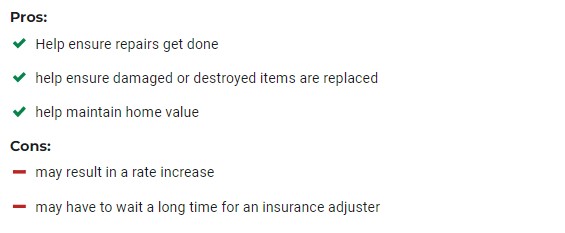

What Are the Pros and Cons of Filing a Homeowners Insurance Claim?

The insurance company helps ensure that healing is carried out quickly and professionally, damaged or damaged subjects, and that life began to go to normal. Join, which can also help keep and develop the value of your home and can still result in less maintenance and repair over time.

However, the submission of the application may file in Tareteferring, even if you move to insurance companies or go to the new house in the future to the new house. Insurance companies use a common database with history, with detailed information, including your name, age and specified, with specific claims, with specific claims, specific claims, specific claims, with specific claims, with specific demands, specifically entered and settlement.

Middles also means submission that you should go through the process to wait for insurance to find damage and find suppliers to treat something willing to pay business. Depending on the nature of the claim, which can mean long waiting. At the end of the storm, wild fire, tornado, as another occurrence that has many houses will probably have an offer. The longer you wait until they lie to the longer you need better.

Meanwhile, you can skip the reporting process, you can save time and give you more freedom to choose which you repair to create your own schedule and to what extent. It also prevents a high dispute with your insurer if you are not satisfied with the offer offering.

How Can Filing a Homeowners Insurance Claim Impact My Rates?

There is no doubt that applying to your homeowner's insurance company can result in an increase in rates - one that you can go through for a while. This is especially true if you have a long history of damage. You may still be at risk of being sued by your insurance company. Indeed, insurance companies contribute to the claims information database, called the Comprehensive Loss Underwriting Exchange (CLUE), and use it to help them set and adjust prices. Every claim you make is saved and saved for years. A simple call and a complaint request can trigger a flag in the CLUE system and can identify you as an additional risk. And this record will travel with you even if you decide to buy competitive offers from other home insurance companies.

While it's good to know about CLUE, it shouldn't stop you from making a complaint if you have to. Of course, if your house starts to burn, you should call your insurance company. But when you put the car back on the gate and it falls, you can change your mind twice. It is important to consider the amount of damage with possible damage without worrying too much about raising rates or losing your insurer.

"The insurance company wants you to stay a customer," Feinman said. "It's too expensive to get a customer." It encourages homeowners to think about the overall picture and ask questions for a vision. "Do you have a lot of complaints? "Expensive complaints, that's what they're worried about," he said.

How Are Homeowners Insurance Claims Paid?

Insurance companies usually pay for damages by electronic transfer or control of funds, although more complex claims may involve more payments that are made during the repair.

Depending on the severity of the damage, you may receive an initial payment upon claim. The point is to help you with immediate expenses or to pay for shelter and food as needed, in addition to paying for any necessary repairs. In some cases, such as small claims, the initial inspection may be a direct settlement of the entire claim. If you accept this payment, you have the opportunity to file another claim later if further damages are found. You can also quarrel with precipitation if you feel insufficient, and think about renting public opinion on the second opinion if you are not satisfied with your insurance company.

If the same structures and your possessions are damaged or destroyed, you can get a separate payment for each. You can also receive a separate control for living expenses or switching life and other or damage is caused by floods and covered with other politics.

If you have a loan in your house, checks are usually done by your girlfriend and your creditor. Banks and mortgage companies must often be referred to the home conscience policy and that they are aside in each insurance. The same applies if you have an apartment or co-op. Your borrowers can apply for all funds to apply for an ESCROW account and go directly by their supplier because the work continues. Thesis controls may be necessary before the final payment is issued.

What Are Mistakes to Avoid in Filing a Homeowners Insurance Claim?

If you are entitled to, immediately inform your insurance company for an event that requires entitlement. Follow and submit and submit a receivable in time when your insurer is enabled. DOC Losing photos, videos and list of items lost or damaged by the dollar amount where it is available.

Remember to follow your insurance companies and state requirements, how long you need to qualify. They don't give rise to tensile if you don't need. For small damage or any correction that is smaller than you receive, you can be better than demand. The submission of entitlement can manage home home insurance insurance or even the cause of your insurance company.

Focus on details because you cannot be placed on what remains in your claim. The larger claim, the more important this process can be. Tormy air that falls a tree in the fence in the fence a relatively direct loss of document and reporting, while the fuel-breakdown at home uncomplicated. Here, for the first time, it is very important to create a photo or video of the content of your home, as well as maintaining an ongoing inventory of your property. "People underestimate how much they have," Feinman said.

This brings us to one of the biggest mistakes people make when buying home insurance: they don't buy adequate coverage. "People make the mistake of buying only because of the price," says Janet Ruiz of the Insurance Information Institute. Homeowners need to consider how much the building will cost, he added. Include all important information about your house using, like material quality. "Is the carpet on the floor or hardwood? Do you have a granite or laminat counter or fine art?" Ruiz asked. "Remember to update your range when you make changes."

Finally, he doesn't always think that your insurer is good and accepts what they offer. Don't be afraid to claim a statement and fight a lot of payments when you get. Your insurance company may not get you, but it doesn't want to pay more than it needs.

How Long Does It Take to File a Homeowners Insurance Claim?

Depending on the complexity of your claim and how to do your homework, you can take a few days to order homeowner owner. The process can be upright for flooded basement or fallen wood, but it can be more time consumed when there are other factors.

It is possible to fill a simple complaint form while you are on your online computer, but the owner claims to complete the session to be something like a little damage to the fence that does not serve repairs. Any assertion that you run the risk of increasing your rates and some are not sufficient risk. For most of the entitlements, insurance companies send insurance companies if you send to your house to check the cost of repair. Quickly avoid or take long, especially after a storm or many people in your area.

Storms with wind damage and floods can be explained to submit two different insurance companies - your Aiot, which is not part of Homowers flooding policies. This can also delay the process.

Your insurance contract will contain information about how much time you can send a complaint, and most states have rules and time boundaries for you and your insurers. The key is to ensure the timely delivery of all necessary documentation, along with photographs and a list of lost items of estimated value. The more detailed, the better.

How Long Does It Take to Pay Out a Homeowners Insurance Claim?

Processing an application for real estate insurance can take from several weeks to several years. The time depends on the type and complexity of your claim, how much damage has been done and how careful you are about the filing process. "A simple complaint will be settled in a relatively short time," Feinman said. "If the house starts to burn, it will take you longer to gather information about the loss, and it will take longer for the insurance company to settle the claim." Building a house after a total loss can take 18 to 24 months, according to the United Policyholders group on consumer protection.

While there are some factors you can't control, there are things you can do to speed up the process. It is important to provide as much detail as possible in your claim, from police and fire reports, if possible, to photographs or videos of the damage, together with inventory and the estimated amount of property lost. Make sure you submit all documentation within the time allowed by your insurance policy and your state.

Any type of dispute can prolong the process, such as disagreement over the amount of compensation or who should pay for the claim if more than one insurance company is involved. For example, if storms cause floods and wind damage, it can be difficult to resolve liability. Wind damage is usually covered by the homeowner's insurance, but flood insurance requires a separate contract. "After a storm, it can be very difficult to determine if the damage is caused by wind or water," Feinman said.

Delays can also occur if significant damage caused by a storm over a long period of time prevents access to your area or makes it difficult to obtain supplies. Contractors may also take longer to complete the contract than promised or do bad work that needs to be done again.