About Allstate

Founded in 1931, Allstate has grown to be one of the largest insurance companies in the United States with nearly $ 45 billion in sales by 2020 as well as employees, agents and support staff. 87,000. It has about 16 million customers with over 175 million plans in all 50 states and Washington, DC Allstate has several other insurance companies, including Encompass Insurance, SquareTrade and Esurance. It has an A + financial strength rating from AM Best.

In 1952, Allstate also established the Allstate Foundation, a charitable organization, strengthening non-profit organizations, assisting domestic violence victims, and supporting students and teachers. .

In 1952, Allstate also established the Allstate Foundation, a charitable organization, strengthening non-profit organizations, assisting domestic violence victims, and supporting students and teachers. .

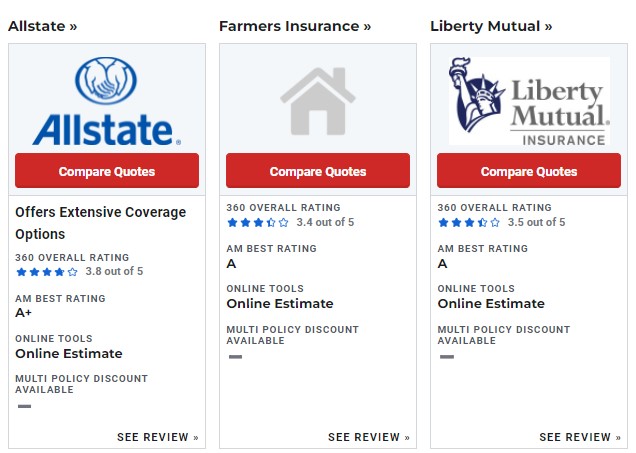

Popular Home Insurance Companies

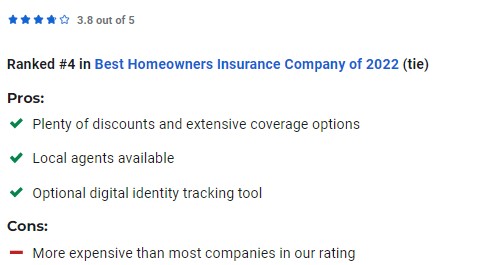

Allstate Review

Allstate is not. 4th place in our ranking of the best home insurance in 2022. It lives up to its name and offers insurance in all US states except Washington DC However, this has not yet become our lowest mortgage insurance Dear. At $ 169 per month, this is the most expensive store we can collect price data on. It is considered to fit well financially, as well as the AM Best A + brand. Allstate offers a variety of insurance options that can be added to standard standards and further charged for items that may be higher than appropriate or worthwhile, such as golf clubs, oil lawn and accessories. However, unlike the USAA, its primary projections do not cover the cost of representation.

Allstate is the primary insurance provider that provides coverage for parts of the home, which provides additional protection for your property when renting your home through sites like Airbnb. The identity theft system of choice is also available. The company will pay you if your identity is stolen, but there are tools to prevent this. Allstate also provides applications that display your digital fingerprint to help you understand who owns your personal information. Allstate offers many discounts to help you save money. This does not include complaints and fees for new customers, as well as a discount if you buy insurance more than seven days before the end of the old one. You can also save up to 25% by combining Allstate home insurance with car insurance.

Allstate also offers an online marketing tool that you can use to plan coverage and save deals you may later receive. In most cases, however, it is best to talk to a representative to get a more detailed description of the price and insurance.

Allstate also offers an online marketing tool that you can use to plan coverage and save deals you may later receive. In most cases, however, it is best to talk to a representative to get a more detailed description of the price and insurance.

What Homeowners Insurance Coverage Options Are Available From Allstate?

Allstate standard home insurance covers coverage and attached accessories such as a garage. The standard policy provides you with protection against fire, smoke, theft, graffiti and weather damage (including hail, wind and lightning).

Here are some details about the coverage provided by Allstate Homeowners Insurance:

Roof cover: Cover the physical structure of your home, such as roofs and walls. It will also cover damage to other buildings in your home, including a parking lot or building, pool or fence. Home insurance covers losses or damage caused by fire and smoke, lightning, wind, hail, theft and appliances. Allstate also provides additional forecasts to cover damage caused by floods or earthquakes.

Include personal belongings: Include items in your home, such as furniture, electronics, appliances and even clothing. Personal property coverage will depend on what is lost or damaged. You can actually pay for useful items since the first purchase. As an option, you can be offered a flexible price, which you can use to buy new items of the same class and quality. You can choose high quality insulation to protect your valuables in your home.

Debt Consolidation: Helps protect you in the event of accidental damage to property. If you are arrested, as a family member, legally, occupational safety can help cover legal costs and repairs as well as similar policies.

Guest health insurance: Debt protection can help cover legal fees if you are sued, if someone has damaged your property. Guest health insurance can help cover the health costs of the injured person (such as a visitor). These may include x-rays, surgeries, dentists, ambulances and hospital stays.

Allstate insurance policies are also available to landlords, tenants, homeowners, and homeowners. Although the cover is always the same as the house cover, these plans are designed to cover things like the loss of a loan after a storm or an application in an indoor cabinet that cannot take the property of self.

Allstate insurance policies are also available to landlords, tenants, homeowners, and homeowners. Although the cover is always the same as the house cover, these plans are designed to cover things like the loss of a loan after a storm or an application in an indoor cabinet that cannot take the property of self.

What Homeowners Insurance Discounts Are Offered by Allstate?

Allstate offers various discounts to help you save on mortgage. To ensure you get the best rates and insurance for your home, the company recommends that you and an insurance professional can help you determine your budget. Some safety options include:

Insurance coverage: By combining home insurance with car insurance or other insurance, Allstate Company promises to save up to 25%.

Simple payment plan: By subscribing for automatic payments, you can save up to 5%.

Free Reimbursement: Allstate offers up to 20% refund for new customers without new announcement or transfer to Allstate.

Short-term insurance equipment: Homes with alarm systems or other forms of protection against fire or theft may be eligible for a reduction in rates.

First Bird Reduction: Allstate offers owners a maximum of 10% off who sign up for a new minimum order seven days before their current forecast expires. Acceptance and Deposit: New Allstate customers can save up to 10% per year on transfers from other companies. This reduction will continue each year of your stay at Allstate.

Rent repayments: New homebuyers or buyers may qualify for a refund.

Reduced wages and checkout. If you have used a good payment method in the past, such as an initial down payment or a full refund, you may be eligible for a discount. To learn more about cost savings, see how we can prepare for the auto insurance section.

What Additional Homeowners Insurance Coverages Are Offered by Allstate?

Allstate has a number of options to add or increase coverage beyond standard home insurance. It is always a good idea to consult with an agent or sales representative to determine the best policy for your needs.

Personal Umbrella Policy: The standard Allstate homeowners policy includes liability insurance to protect against injuries to visitors to your property. But this policy has its limitations and you can be short when you reach the limit. The Personal Umbrella Policy provides additional coverage to protect you from loss and injury caused by physical and personal injury, such as property damage. Earthquake insurance: Although not covered by basic insurance, Allstate offers earthquake insurance in select regions. This cover can help repair or replace your home and its interior after an earthquake. Use the Department of the Interior, U.S. Geological survey to determine your proximity to fault lines and the risk of earthquakes. You should contact an Allstate representative to determine if earthquake insurance is available in your area.

Flood Insurance: Like most insurers, Allstate is likely to cover water damage due to an explosion in a pipe or faulty washing machine hose unless the problem is caused by poor maintenance. But floods caused by spilled rivers, oceans or other waters are not included. A separate policy is required for this coverage and may be required by your provider if you live in a flooded area.

HostAdvantage: Allstate is the first major home insurance company to offer home insurance. This additional insurance can help protect homeowners from theft and damage as a result of renting your home.

Identity Theft Recovery: Covers legal fees, free wages, and other related costs if your identity is stolen.

Reversal: Additional coverage for water damage caused by a backlash from a water channel and slurry pumps can benefit many homeowners. The Civil Engineering Research Foundation estimates that the canal line in America is an average of 30 years with canal support increasing by about 3% per year.

Personal Property Strategy: Covers valuable items discussed by the landlord, including antiques, collections and jewelry.

Owning a Business: If you work from home or own a home business, you may need additional insurance. Sports equipment: insurance for you and everyone in your family who stores expensive sports equipment in your home.

YARD & field: Coverage for equipment and machinery for landscaping and landscaping.

Electronic data recovery: If your computer is stolen or damaged, this insurance will cover the cost of recovering your lost data and photos.

Musical Instruments: You can purchase additional coverage for your musical instruments.

Green upgrade compensation: added coverage to help replace damaged and more efficient applications.

Manufactured / mobile home insurance: If you live in a manufactured home or mobile phone, you will need this Allstate insurance instead of basic home insurance. As the name suggests, the most recent is specifically for mobile and installed rooms as well as any other physical system in your home, such as a parking lot. You will also receive housing and private property insurance, as well as guest fees and health insurance.

How Do I Buy Allstate Homeowners Insurance?

You can buy homeowners insurance from Allstate online, by phone, or by contacting your nearest Allstate representatives. Before you start trading, decide how much you want to pay. Calculate the cost to repair your home and replace your property. A home listing can help, but there are online tools to measure home prices in your area. Gather all the important information about your equipment, including address, home age, and any recent changes, including home repairs or replacements. The age of large appliances, such as water heaters, whether you have a chimney, or plumbing or electrical work recently, are other questions you may ask yourself.

Decide how to get a statement. You can start this process on the Allstate website by calling Allstate immediately, or you can use the online tool to find a representative in your area.

Provide details about your equipment, including address, age, building materials, and recent repairs.

Get an update of your current insurance policy recently. If you are using a website, they will provide you with a plan after submitting the required information and / or directing you to a representative to receive a statement.

How Do I File a Homeowners Insurance Claim with Allstate?

If you want to apply for a home insurance policy, you can do so by phone, online, or through the Allstate application. To submit your statement, follow these steps:

If the injury involves a crime, such as theft or vandalism, first contact a police officer and file a police complaint.

Contact Allstate as soon as possible. You can file your complaint online, through the mobile app, or by calling your Allstate representative. Be prepared to provide an explanation of the injury, its cause and when it occurred. Copy photos and video damage. You can also do this in the application.

Repair any damage that may occur to your home again, such as leaks, and keep receipts for all services.

After you submit your application, you will be assigned an application number so that you can keep up with the status.

Allstate will review the claim and send you a repair repair plan.

Allstate vs. the Competition

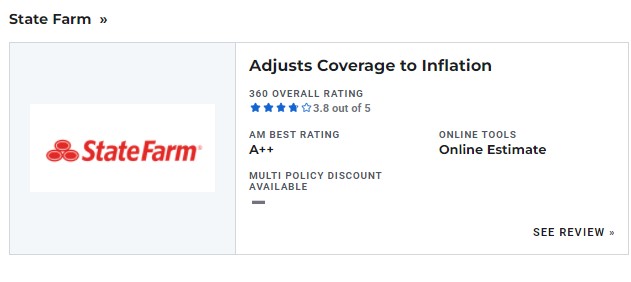

Allstate vs. State Farm

State Farm and Allstate are large nationwide insurance companies with a network of local agents living in your community. She drew # 4 in our top homeowners' insurance companies in 2022. State Farm has an A ++ rating from AM Best for financial strength and Allstate earns A +. Both offer the same basic coverage options and different coverage options.

State Farm has fewer options than Allstate, but Allstate has many discounts. You can use mobile applications and online account tools to manage your policies anywhere, but the biggest advantage of these companies is their on-premises representatives, so your choice may depend on which agent you feel most comfortable with.

For more information, see our full comparison of Allstate vs. State Farm Homeowners Insurance and read our State Farm review.

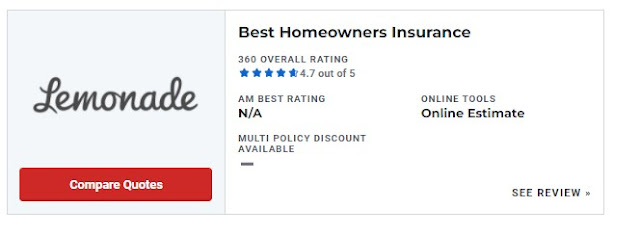

Lemonade

No lemonade. 1 of our top homeowners insurance companies ranked in 2022, while the Allstate band is for them. 4. Companies are also honest in terms of costs, with Lemonade costing $ 165.75 per month and Allstate $ 169, according to our research.

However, Allstate offers many more discounts than Lemonade, and you can combine home insurance with car insurance. In addition, Allstate is offered in every state and Lemonade is only available at 23. (Both are located in Washington, D.C.)

Lemonade includes the cost of conversion to its standard policy, while Allstate does not. One hurdle for everyone is that Lemonade only sells its policies online or through the app, there are no agents you can call until you become a customer. Allstate has its agents on site who can visit you in person if you wish.

FAQ

What Does Allstate Homeowners Insurance Cover?

Allstate Homeowners' policies cover your home and other buildings on your property against damage caused by fire, smoke, theft, graffiti and weather, including hail, wind and lightning. The standard policy also includes personal property ownership to help you exchange furniture, clothing and other items in your home. It also includes medical coverage for visitors and liability protection to help pay medical expenses and any litigation if a visitor is injured on your property.

What Does Allstate Homeowners Insurance Not Cover?

Allstate's standard policy does not cover damage caused by floods or earthquakes, which require additional coverage and may be required by your lender depending on where you live.

Backing up water from a clogged sewer or defective sludge pump is also not included in the standard policy, but is available at an additional cost. Precious art, jewelry or collections may require special coverage, such as a home office if you work from home.

Renting an apartment or space in your home to a tenant may also require additional coverage along with farm buildings or structures that are not part of the main structure.

How Much Is Allstate Homeowners Insurance?

Allstate is estimated to be the most expensive carrier at $ 169 a month for a $ 450,000, 2,400-square-foot prototype village house in Naperville, Illinois. Your own costs will vary depending on a number of factors, including:

Location: The location of your home and geographical factors, such as regional weather trends, play an important role in determining how much you pay for insurance.

Size: In general, the larger the house you have, the higher the cost of insurance.

Age and condition: Prices may vary depending on the age and condition of your house. Old roofs that need to be replaced, or building materials that are no longer in use, can increase your prices.

Insurance history: If you have history left damage insurance, you can find a discount on home insurance.

Value of your items: If you have a lot of items, you can pay more for more insurance for your items.

Does Allstate Homeowners insurance cover water damage?

A cracked pipe or defective washer hose may be covered by the Allstate Homeowners' fuse, but water damage due to improper maintenance may not.

Damage caused by water overload, such as river flooding or storm surges, or water damage by a clogged ditch or defective pump, is also not covered. However, both can be covered by optional insurance.

Does Allstate Homeowners Insurance Cover Theft?

Loss of theft is included in the standard insurance of Allstate homeowners, but valuable jewelry, art or other collections may require additional coverage.

Does Allstate Homeowners Insurance cover roof leaks?

The standard cover covers roof leaks due to sudden damage, such as a tree branch falling during a storm. However, leaks caused by insufficient maintenance should not be covered.

Does Allstate Homeowners insurance cover wood damage?

Damage can occur if the tree is healthy and covered by the wind. If the tree is not in good condition when it falls, it may be considered a lack of maintenance and cannot be covered by your insurance policy.

Regardless of the situation, a fallen tree is unlikely to cover it if it falls into your home without damage. Coverage will vary depending on the situation and your agent is the best source of information.

Does Allstate Homeowners Insurance cover injuries?

The standard policy provides coverage for injuries to guests, but you may want to consider additional coverage if you have a trampoline, pool or other items that increase your risk.

Does Allstate Homeowners Fire Insurance cover?

Allstate Standard Homeowners' insurance covers damage caused by fire. Fire insurance is an important part of your home insurance.

According to the National Fire Protection Association (NFPA), between 2014 and 2018, home fires accounted for 27% of reported fires, and the U.S. fire department intervened nearly 353,100 building fires each year. The NFPA states that cooking, heating, such as electricity, and lighting are the main causes of home fires.

What is Allstate Host Advantage?

Allstate Host Advantage is designed to cover homeowners who rent some or all of their homes to others for a short period of time through an online booking site. This will help compensate for damage or theft.